The chancellor is expected to announce a cut in National Insurance for millions of workers in his Autumn Statement later on Wednesday.

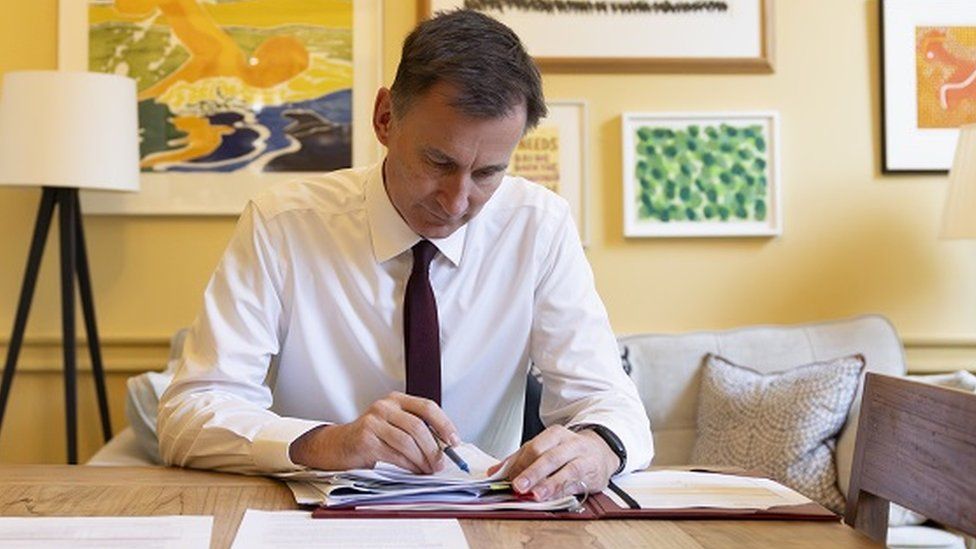

Jeremy Hunt's mini-budget will also feature a cut to business taxes and tough new benefit sanctions.

He will also unveil measures to boost business investment by £20bn a year in moves to "get Britain growing".

The Institute for Fiscal Studies (IFS) says UK tax levels are at their highest since records began 70 years ago.

Labour's shadow chancellor Rachel Reeves said nothing Mr Hunt says could change the Conservative's "appalling record" on the economy.

Many Conservative MPs are desperate to see the tax burden eased.

Former home secretary Dame Priti Patel told the BBC: "This is a really pivotal moment.

"Successive Conservative governments are known for targeted tax cuts that basically put more money into people's pockets."

And yet Dame Priti and hundreds of her colleagues know people's taxes have shot up and plenty think public services haven't improved to match.

The cost of Covid and the amount paid in interest on the national debt - the highest for decades - is seen by many economists as a key reason for this.

And so the Autumn Statement is Rishi Sunak's latest attempt to seize the political agenda and improve the Conservatives' standing in the opinion polls.

Some details of the Autumn Statement have already been revealed, including a 9.8% increase to the minimum wage to £11.44 per hour. The new rate, which comes into force in April, will also be expanded to 21 and 22-year-olds from the first time.

Mr Hunt will also set out details of a £2.5bn overhaul of benefits for people with long-term health conditions or disabilities, or those facing long-term unemployment.

The government has announced plans to make benefit claimants who fail to find work for more than 18 months undertake work experience placement or face losing access to government support.

Stricter penalties will also apply to long-term unemployed people who the government decide are not adequately looking for jobs.

For businesses, it is understood the chancellor is set to extend the tax break knows as "full expensing" for businesses through to 2028-29.

The "full capital expensing" policy allows companies to deduct spending on investment from profits, meaning they have to pay lower amounts of corporation tax.

The tax break was due to expire in 2026.

It is not currently clear whether Mr Hunt intends to cut the level or the thresholds of National Insurance (NI).

NI is a fixed percentage of the money you earn which is deducted from your wages. NI payments, which were introduced in 1911, contribute to the cost of benefits, the NHS and the state pension.

The move will make no difference for employees under pension age who earn less than £12,570 a year, as they pay no NI. People over the state pension age, even if they are still working, do not pay NI.

For employees on between £12,570 and £50,268, the current NI rate is 12% on earnings and 2% on profits above that.

In April 2022, the NI rate went up to 13.25% to help fund the NHS and social care, but the increase was reversed in November 2022.

'Reject high tax'

Mr Hunt will say: "Conservatives know that a dynamic economy depends less on the decisions and diktats of ministers than on the energy and enterprise of the British people.

"The Conservatives will reject big government, high spending and high tax because we know that leads to less growth, not more."

He will claim the government "will back British business with 110 growth measures" including "removing planning red tape", boosting foreign investment and cutting business taxes.

Speaking ahead of the statement, Labour's Rachel Reeves said: "The Conservatives have become the party of high tax because they are the party of low growth.

"After 13 years of economic failure under the Conservatives, working people are worse off.

"Prices are still rising in the shops, energy bills are up and mortgage payments are higher after the Conservatives crashed the economy."

Turning point

With a general election expected next year, the dance in advance of the speech has included the usual nods and winks, briefings and interviews - with no shortage of speculation about a huge range of potential tax cuts, which the Treasury has done little to dampen down.

Until last week, Mr Hunt has downplayed the chances of tax cuts, claiming they were "virtually impossible" until inflation was under control.

Ministers now say tax cuts will happen but claim they will be done in a "responsible" way.

In a speech on Monday, the prime minister made repeated references to tax cuts and claimed last Wednesday's drop in inflation appears to have signalled a turning point for the UK's flatlining economy

Mr Sunak said the government was now able to cut taxes, after the pace of price rises eased.

He said his target of halving inflation this year had been met.

But the new focus - given next-to-no economic growth - is to try to get the economy growing.

https://news.google.com/rss/articles/CBMiL2h0dHBzOi8vd3d3LmJiYy5jby51ay9uZXdzL3VrLXBvbGl0aWNzLTY3NDg3ODgz0gEzaHR0cHM6Ly93d3cuYmJjLmNvLnVrL25ld3MvdWstcG9saXRpY3MtNjc0ODc4ODMuYW1w?oc=5

2023-11-22 07:19:44Z

2597588571

Tidak ada komentar:

Posting Komentar