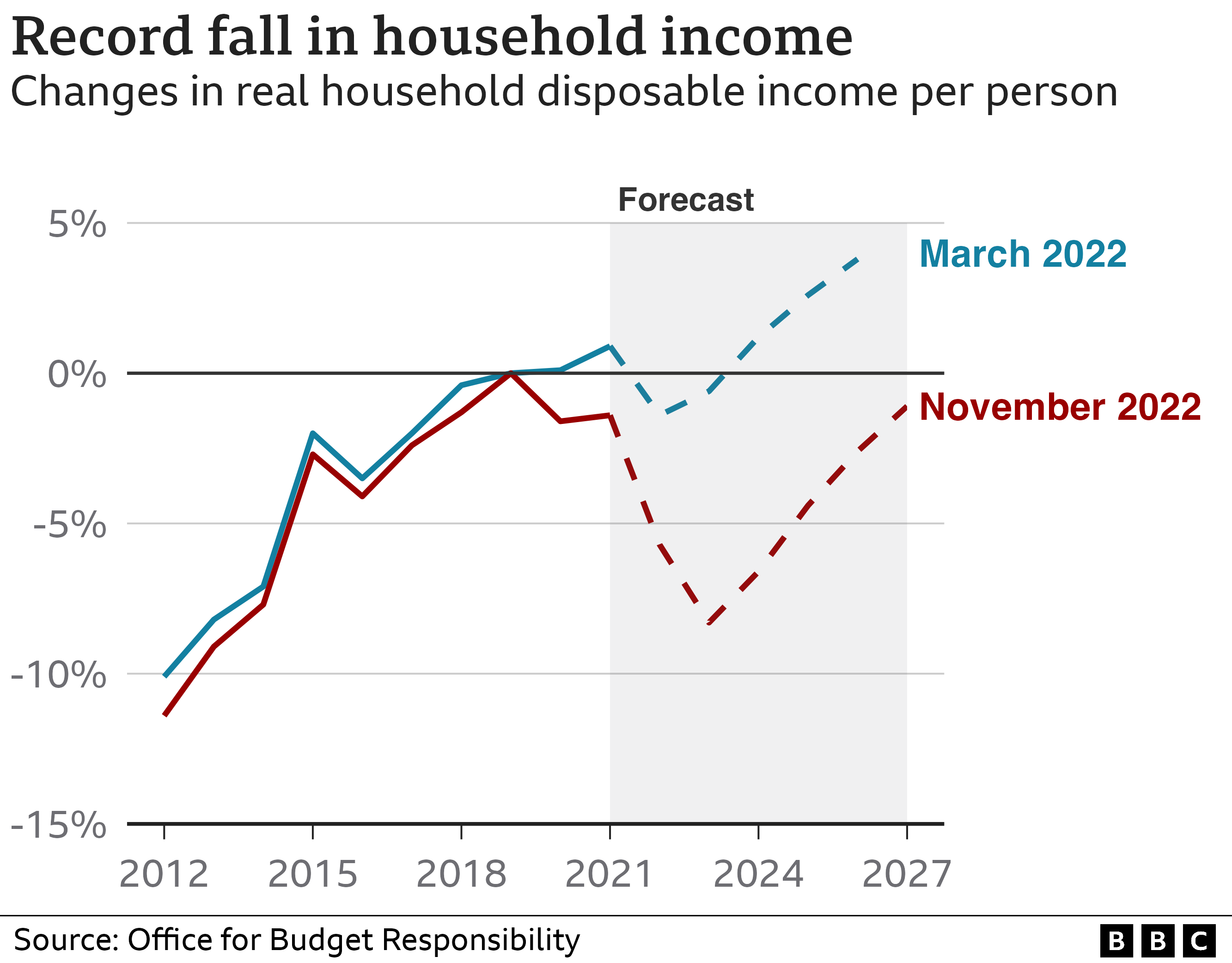

The UK faces its biggest drop in living standards on record as the surging cost of living eats into people's wages.

The government's forecaster said that household incomes - once rising prices were taken into account - would dive by 7% in the next few years.

It also expects the number of people who are unemployed to rise by more than 500,000.

It came as the chancellor said the UK was already in recession and set to shrink further next year.

But Jeremy Hunt said his Autumn Statement - which unveiled £55bn of tax rises and spending cuts - would lead to a "shallower downturn" with fewer jobs lost.

Energy and food bills have shot up due to the war in Ukraine and pandemic, and are squeezing household budgets.

Inflation - the rate at which prices rise - is at a 41-year high which the Office for Budget Responsibility (OBR) says is dragging on the economy.

The forecaster said price rises were likely to peak at 11% in the final three months of this year, thanks largely to the government's energy price guarantee scheme which limits bills.

However, it said inflation would still "erode real wages and reduce living standards" this year by the biggest margin seen since 1956, when records began.

It expects household incomes when adjusted for inflation to fall back to the levels they were in 2013. It will then take six years for them to recover, although they will still be "over 1% below pre-pandemic levels" by 2028.

Compounding this situation, the OBR said, will be rising interest rates, which the Bank of England has already put up to 3% to try to battle inflation.

House prices are also forecast to fall by about 9% over the next two years as a result of higher mortgage costs.

Taken together, the OBR thinks this will tip the economy into a recession "lasting just over a year" as consumers spend less and businesses cut investment.

It expects the UK economy to shrink by 1.4% in 2023 before growth gradually picks up again.

The forecaster also thinks the unemployment rate will rise from 3.6% today - near a record low - to 4.9% in 2024 before falling back.

A recession is defined as when a country's economy shrinks for two three-month periods - or quarters - in a row.

Typically companies make less money, pay falls and unemployment rises. This means the government receives less money in tax to use on public services.

Claire Mills, from Matson in Gloucester, is unable to work due to health issues. She says the whole community is worried about the rising cost of living.

"This is a council estate. There are young families, single parents and they can't afford this," the 59-year-old told the BBC.

She wants the government to do more to help the poorest households.

"The prices have doubled in some supermarkets for certain things," she says. "And the gas and electric is nearly a mortgage payment - it's ridiculous."

Mr Hunt hopes his Autumn Statement will help restore the UK's economic credibility after the controversy of September's mini-budget.

Investors were spooked by the mini-budget's promise of large, unfunded tax cuts, with the pound falling to a record low and government borrowing costs shooting upwards.

Mr Hunt, who has scrapped most of his predecessor's plans, promised on Thursday to bring government debt down as a percentage of economic output within five years under a new fiscal rule, not three years as under the previous plans.

He added that the budget deficit would be brought below 3% of output - or gross domestic product (GDP) - within five years.

On Thursday, the pound fell slightly against the US dollar after Mr Hunt delivered his statement. The government's borrowing costs remained broadly unchanged.

'A perfect storm'

This is likely to be a relatively shallow recession for the economy as a whole - but for households, it will mean the wipeout of gains in living standards, a return to 2014.

It's a consequence of multiple factors. Looming large has been a spike in energy prices and food costs. The government support package has cushioned only part of the blow inflicted by the former.

Then there's the policy response to soaring inflation: increases in interest rates from the Bank of England, designed to reduce price pressures by squeezing finances. The official forecasts reckon that house prices will fall by more than 5% in 2024 as buyers feel the pinch.

And there are the tax rises, targeted towards the better off, which will slowly eat into their fortunes. The tax man is set to take the biggest slice of the nation's income since World War Two.

Hard pressed employers, too, are granting pay rises that are failing to match the cost of living - and ultimately, the Office for Budget Responsibility predicts, they will cut over 500,000 jobs.

It's a perfect storm. Households may be far from clear of it by the time the general election approaches in 2024.

With additional reporting from Katie Thompson

https://news.google.com/__i/rss/rd/articles/CBMiLGh0dHBzOi8vd3d3LmJiYy5jby51ay9uZXdzL2J1c2luZXNzLTYzNjU5OTM20gEwaHR0cHM6Ly93d3cuYmJjLmNvLnVrL25ld3MvYnVzaW5lc3MtNjM2NTk5MzYuYW1w?oc=5

2022-11-17 15:25:31Z

CBMiLGh0dHBzOi8vd3d3LmJiYy5jby51ay9uZXdzL2J1c2luZXNzLTYzNjU5OTM20gEwaHR0cHM6Ly93d3cuYmJjLmNvLnVrL25ld3MvYnVzaW5lc3MtNjM2NTk5MzYuYW1w

Tidak ada komentar:

Posting Komentar