Millions of pensioners are facing a £1,000 hit from Rishi Sunak and Jeremy Hunt’s stealth tax raid, amid a growing backlash over the Chancellor’s decision to prioritise millennials in the Budget.

The Resolution Foundation and the Institute for Fiscal Studies (IFS) said the elderly and higher earners would be the biggest losers by the end of this parliament because pensioners will not not benefit from recent cuts to National Insurance.

In its analysis of the Budget, the Resolution Foundation warned that eight million retirees faced an average £1,000 hit to their incomes as a result of a six year freeze on income tax thresholds.

Paul Johnson, director of the Institute for Fiscal Studies (IFS), said pensioners paying higher tax rates faced an even bigger hit of £3,000 as a result of policies announced in this parliament.

He added that “well over” 60pc of pensioners were now subject to income tax.

In total, pensioners will be collectively paying £8bn more in taxes by the end of this parliament.

By contrast, the Resolution Foundation’s analysis showed that people aged between 18 and 45 stood to gain £590 on average. Millennials aged between 25 and 34 will benefit most, gaining an average of £620 per household.

The findings led to warnings that the Conservative Party risked alienating voters.

Former employment minister Ann Widdecombe said: “Considering how much of their vote is the grey vote, it’s just unbelievable that in an election year they just decided to pretend we don’t exist.”

Steve Webb, who served as pensions minister in the coalition government, said: “Clearly far too many pensioners have been dragged into the income tax net. The new state pension is nearly the same as the personal tax allowance, so people with just a state pension and a little bit more are now taxpayers. That means millions of people have the hassle of dealing with HMRC in their retirement, so it is disappointing that the tax threshold wasn’t raised.”

The Resolution Foundation said the raid on pensioners marked a significant shift in state support over the past five years, “from the rich and the old to the young and the poor”.

It said this was in “marked contrast” to the approach taken by former chancellor George Osborne in the 2010s, who chose to focus support on pensioners and cut benefits for poorer working-age households.

Senior government sources suggested this was a conscious choice driven by a need to fund the triple-lock on state pensions. The policy guarantees that payments rise in line with the highest of prices, earnings or 2.5pc every year.

Ministers believe that cuts to National Insurance will encourage more people into work and help to grow the economy.

“If we want to keep on increasing pensions by the triple lock, which is an unbelievably good deal, you must have a growing economy that keeps paying for it,” a senior government source said.

The Chancellor cut National Insurance paid by workers by a further 2p in the Budget, matching reductions announced in last November’s Autumn Statement.

Jeremy Hunt was forced to defend his decision to cut National Insurance instead of income tax, insisting the Government had already done an “enormous amount for pensioners”.

He said: “This government introduced the triple lock … we have really prioritised pensioners.”

The Conservatives will pledge to keep the triple lock if re-elected.

Pensioners will not benefit from the National Insurance reductions because they are already exempt from paying it. Many have private pensions as well as state support, tipping them over the £12,570 tax-free threshold or into higher tax bands.

The International Monetary Fund (IMF) welcomed the cuts to National Insurance that it described as being “aimed at incentivising work”.

A spokesman said Mr Hunt had spoken to managing director Kristalina Georgieva following the Budget and described the tax increases used to fund them, including abolishing non-dom status as “well-conceived revenue-raising measures”.

However, the IMF repeated a warning that tax rises would be needed to stabilise debt in the medium term.

While 78pc of the personal tax cuts announced in Mr Hunt’s Budget benefit the richest half of households, the Resolution Foundation said the richest fifth of households would in fact lose an average of £1,500 a year once all tax and benefit changes announced this parliament are taken into account.

Meanwhile, the poorest fifth of households have gained £840 a year. The Resolution Foundation’s analysis found that low income households today stand to benefit from more generous welfare payments compared to 2019.

Support for millennials and younger people announced in the Budget includes keeping more of their £24-a-week benefit for first children after Mr Hunt raised the income threshold at which the state starts to claw back payments to £60,000.

Changes to Universal Credit this parliament means lower income young people keep more of their benefits if they work more.

Meanwhile, the Resolution Foundation said that the Government’s failure to raise tax thresholds in line with inflation meant the average taxpaying pensioner would be £1,000 a year worse off compared to the start of this parliament.

The think tank said: “In total, the policy will have increased taxes for pensioners by around £8bn, a significant portion of the net personal tax rise.

“It is clear that the pensioners’ incomes are set to fall the most as a result of policy changes made during this parliament.”

The Prime Minister’s spokesman said the Government’s “commitment to pensioners is very clear.”

Mr Sunak’s spokesman added: “The Chancellor set out... the priority with National Insurance, which is obviously to cut tax on hardworking families, but he also obviously set out an ambition to end the unfairness of double taxation of income. Now clearly, those above the state pension age already benefit from that.”

Recent polling suggests the Prime Minister’s strategy is risky. Three in five (59pc) of people aged 65 or over voted Conservative at the last election, according to the British Election Study.

However, the Telegraph’s poll of polls shows just 39pc of over-65s plan to vote Tory at this year’s national poll, with 25pc set to back Labour and 17pc supporting Reform UK.

Torsten Bell, chief executive of the Resolution Foundation, described the pace of tax changes over the past few years as “frenetic” with “huge rises and cuts announced in quick succession”.

He said: “Middle earners have come out on top, while taxpayers earning below £26,000 or over £60,000 will lose out. The biggest group of losers are pensioners, who face an £8bn collective hit.”

The Resolution Foundation noted that retirees had benefited substantially from the triple lock on state pensions that ensures payments rise in line with whichever is highest out of inflation, average wage growth or 2.5pc in April each year.

The think tank said: “Pensioners in general cannot be considered to be a low-income group. The triple lock has led to increases in the state pension not just in real terms but also as a fraction of average earnings; and the recent rocketing of interest rates has boosted savings income, particularly benefiting pensioners, while hitting predominantly working-age mortgagors.”

Mr Hunt has extended a freeze on income tax thresholds for six years, boosting Treasury coffers through a phenomenon known as fiscal drag that means more people end up paying taxes as their income rises.

The Office for Budget Responsibility (OBR) has highlighted that if the tax-free personal allowance on work was lifted in line with inflation, it would have reached £16,310 by the end of decade. As things stand, it is estimated to rise to just over £12,800.

The Resolution Foundation said: “High-income households will lose out the most from threshold freezes, while also being affected by other changes to Capital Gains Tax and pension taxes; a few of the very rich will also lose from changes to non-dom taxation.”

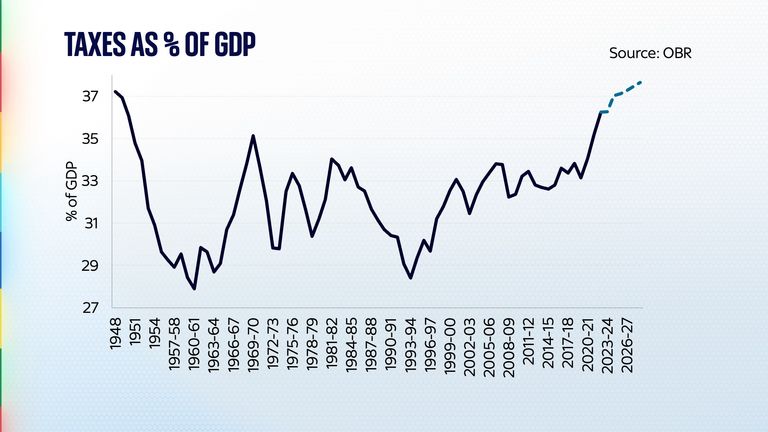

Despite Mr Hunt’s desire to paint the Conservatives as the party of tax cuts, Mr Johnson pointed out that the tax burden remained on course to rise to its highest share of GDP since 1948.

He said: “The context remains one of very big increases in tax over this parliament and more forecast over the next few years.

“Tax has risen to a higher fraction of national income than it has ever been in my lifetime, and I don’t expect it to return to its previous level for the rest of my lifetime.”

https://news.google.com/rss/articles/CBMiaGh0dHBzOi8vd3d3LnRlbGVncmFwaC5jby51ay9idXNpbmVzcy8yMDI0LzAzLzA3L3BlbnNpb25lcnMtbG9zc2VzLXRvcnktdGF4LXJhaWQtaHVudC1ib29zdHMtbWlsbGVubmlhbHMv0gEA?oc=5

2024-03-07 20:01:00Z

CBMiaGh0dHBzOi8vd3d3LnRlbGVncmFwaC5jby51ay9idXNpbmVzcy8yMDI0LzAzLzA3L3BlbnNpb25lcnMtbG9zc2VzLXRvcnktdGF4LXJhaWQtaHVudC1ib29zdHMtbWlsbGVubmlhbHMv0gEA