This video can not be played

To play this video you need to enable JavaScript in your browser.

Chancellor Jeremy Hunt has announced deep spending cuts and tax rises in an autumn statement he said was "fair" and would restore market confidence shaken by his predecessor's mini-budget.

He said about half of his £55bn "plan for stability" would come from tax rises, and the rest from spending cuts.

Mr Hunt said the UK was "now in recession" but insisted his plan would mean a "shallower downturn".

He said "difficult decisions" were necessary to "rebuild our economy".

The Office for Budget Responsibility's forecasts painted a bleak picture, with the UK economy predicted to shrink by 1.4% next year.

Responding to Mr Hunt, Labour's shadow chancellor, Rachel Reeves, said the UK was being held back by "12 years of Conservative economic failure".

"Never again can the Conservatives be seen as the party of economic competence," she said.

In a statement to MPs lasting just under an hour, the chancellor said income tax thresholds would be frozen until April 2028, which means millions of people will pay more tax.

"I have tried to be fair by following two broad principles: firstly, we ask those with more to contribute more; and secondly, we avoid the tax rises that most damage growth," he said.

'Picked pockets'

On public spending, he said department budgets would face real-terms cuts because of inflation and pressure on public sector wages.

Mr Hunt told MPs "this is a balanced path to stability: tackling the inflation to reduce the cost of living and protect pensioner savings whilst supporting the economy on a path to sustainable growth".

Labour's shadow chancellor said by freezing tax thresholds, the Conservatives "have picked the pockets of purses and wallets of the entire country".

In other key measures announced by Mr Hunt:

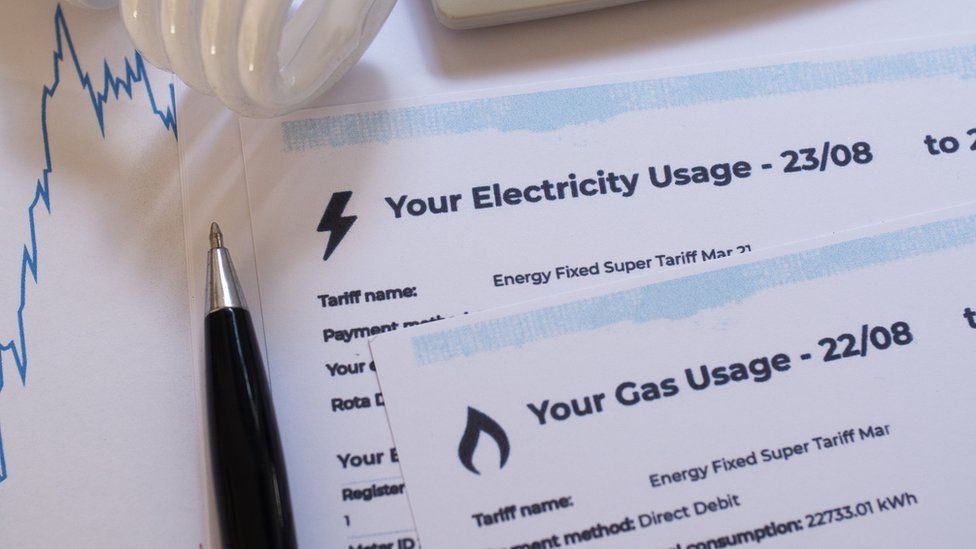

- The household energy price cap has been extended for one year beyond April but made less generous, with typical bills capped at £3,000 a year instead of £2,500

- There will be additional cost-of-living payments for the "most vulnerable", with £900 for those on benefits, and £300 for pensioners

- The top 45% additional rate of income tax will be paid on earnings over £125,140, instead of £150,000

- UK minimum wage for people over 23 to increase from £9.50 to £10.42 an hour

- The windfall tax on oil and gas firms will increase from 25% to 35%, raising £55bn from this year until 2028

The autumn statement is a crucial test of confidence in Prime Minister Rishi Sunak, whose ruling Conservative Party is lagging far behind Labour in the opinion polls.

It comes 55 days after Mr Hunt's predecessor, Kwasi Kwarteng, touted a "new era for Britain", unveiling the biggest package of tax cuts in decades.

Austerity policies?

The so-called mini-budget included about £45bn of unfunded tax cuts and was followed by days of market turbulence, a fall in the value of the pound and rising UK government borrowing costs.

In his statement, Mr Hunt said: "I understand the motivation of my predecessor's mini-budget and he was correct to identify growth as a priority. But unfunded tax cuts are as risky as unfunded spending."

Labour's shadow chancellor said Mr Hunt's autumn statement was an "invoice for the economic carnage" the Conservative government had created.

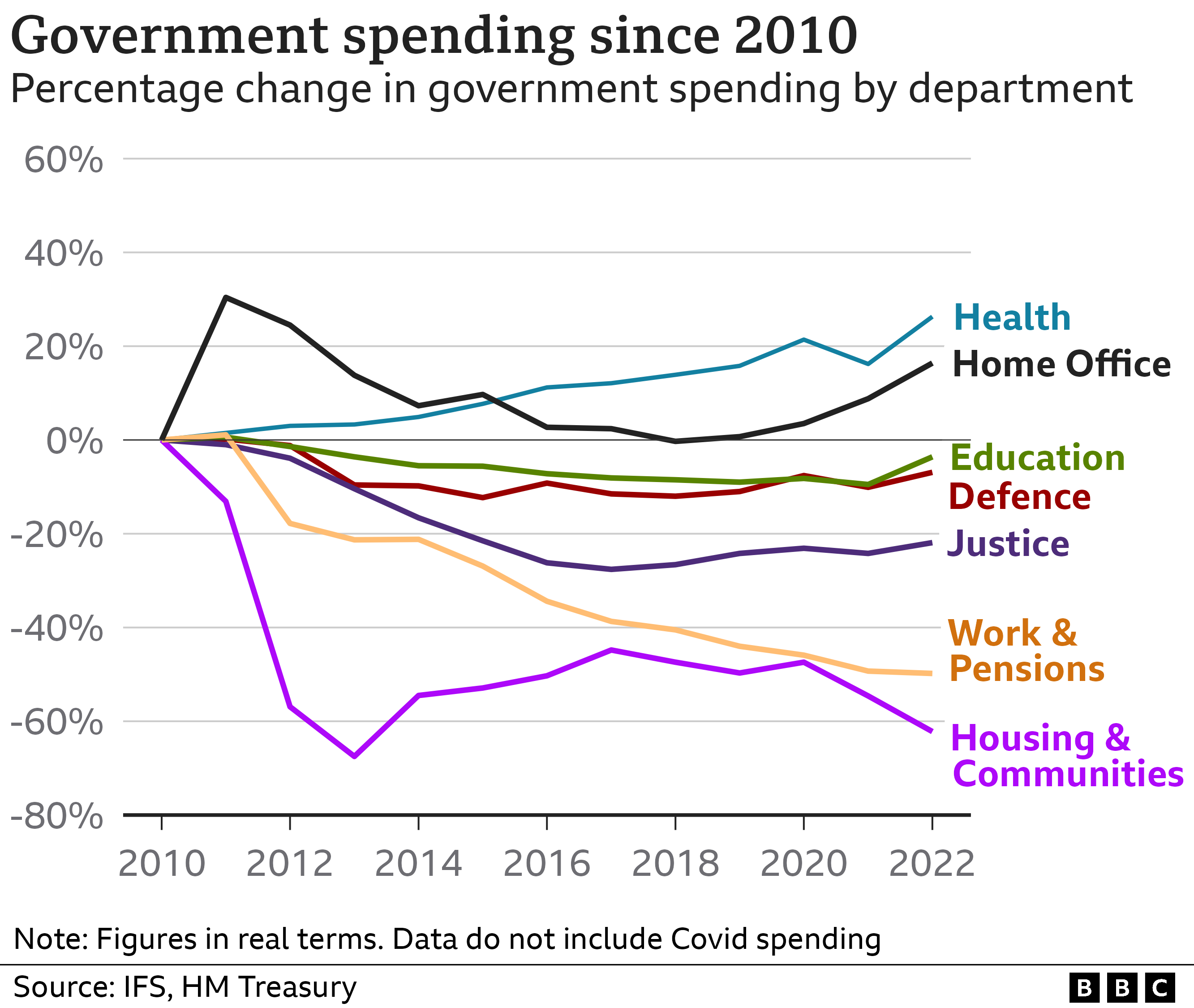

The government has been keen to stress that Mr Hunt's statement does not amount to a return to the austerity policies of the Conservative-Liberal Democrat coalition government, in office between 2010 and 2015.

The balance of spending cuts to tax rises announced by Mr Hunt is more even than the 80% to 20% ratio under the coalition government.

Mr Sunak's government argues the measures are needed to fill a so-called fiscal black hole - the gap between what the government raises and spends.

But some economists have questioned the need for spending cuts and tax rises on this scale and say the decisions being made are political.

Facing down those critics, Mr Hunt said "you don't need to choose either a strong economy or good public services", adding "only the Conservatives you get both".

https://news.google.com/__i/rss/rd/articles/CBMiL2h0dHBzOi8vd3d3LmJiYy5jby51ay9uZXdzL3VrLXBvbGl0aWNzLTYzNjYyMTQy0gEzaHR0cHM6Ly93d3cuYmJjLmNvLnVrL25ld3MvdWstcG9saXRpY3MtNjM2NjIxNDIuYW1w?oc=5

2022-11-17 12:35:11Z

1648934787